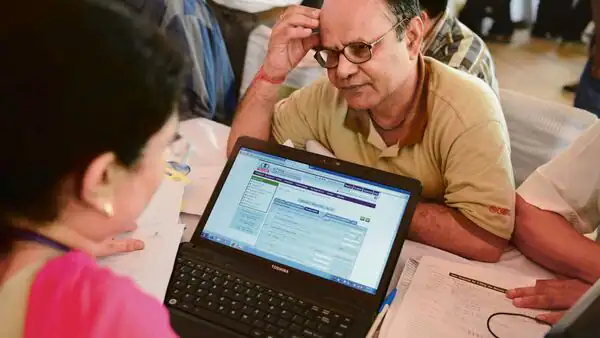

Income Tax Return (ITR) filing is done, now waiting for an income tax refund. Is there any delay in getting a tax refund? If you are eligible for a refund, how much time does it take? But first, check whether you have e-verified your ITR. If you do not e-verify your ITR, the filing process is treated as incomplete and your ITR becomes invalid.

As people are waiting for their tax refunds to be credited, a new phishing scam in the name of an ‘income tax refund’ message is doing the rounds on social media. The government’s official fact-checker, PIB FactCheck alerted people against fake messages regarding income tax refunds.

Mumbai-based income tax and investment expert Balwant Jain said that you will get the refund after your ITR is processed. “Please note that the refund does not come instantly but will be issued to you after the details of taxes already paid are verified by the income tax department from the information available with it,” Jain said.

“As per the press release by the income tax department 61% of e-verified returns have already been processed – which means an intimation for processing, refund, or adjustment whichever applies must have been sent out, and refund due if any is usually credited between 10 days to 2 weeks after processing,” said Archit Gupta, Founder and CEO, Clear

“Normally, it takes 20-45 days for the refund to reach you after filing and verifying your ITR. However, this FY 2022-23, the tax department has expedited the processing of Income Tax Returns (ITRs) using advanced technology. As a result, the average processing time has been impressively reduced to only 16 days,” said Abhishek Soni, CEO and Co-founder of Tax2win.

Hence, the timing of your filing and the accuracy of your data play a major role in the ITR processing speed and receiving your refund, added Soni.

How to check income tax refund status online

-Go to the income tax India website

-Log in using your USER ID (PAN number), the password, and the captcha code.

-Go to the ‘View Returns / Forms’

-Click on ‘Select An Option’ and then click on ‘Income tax Returns’ from the drop-down menu.

-Fill in the assessment year and then submit.

-Click on the relevant ITR acknowledgment number to check your ITR refund status.

Taxability of income tax refund

According to Balwant Jain as far as the taxability of the amount received is concerned, the net amount of excess tax paid is not taxable at all. As per the provisions of the income tax act, the taxpayer is entitled to receive interest in respect of excess of advance tax and TDS/TCS over the net tax liability.

Source By: livemint

Share: